|

College of Business

Department of Finance

|

|||

|

A funding fee must be paid to VA unless the Veteran is exempt from such a fee. Under the Home Loan Guaranty program, VA does not make loans to Veterans and Servicemembers; VA guarantees loans made by private-sector lenders. This VA appraisal estimates the value of the property. It's your responsibility as a home buyer to have the property properly inspected. Information on the Specially Adapted Housing program for certain seriously disabled Veterans. These often-overlooked expenses can include everything from title insurance to lawn mowing. Interest Rate Reduction Refinancing Loans. ST Louis Apartments That Will Approve You With Bad CreditInterest rates are subject to change due to market fluctuations. However, now is a good time to shop VA lenders to determine who can offer your best financing. At Botanical Interests our goal is to inspire and educate the gardener in you. The guaranty means the lender is protected against loss if you or a later owner fails to repay the loan. The montel williams loan is one of the payday loans or cash advances available. The name of the command providing the information. Get fast online cash advance payday loans with no faxing required. See an independent evaluation of the Loan Guaranty program here. We also do blacklisted loans and which bank and finance will give personal loan with bad credit can assist clients nationwide. VA's maximum guaranty amounts are established annually, and vary, depending on the size of the loan and the location of the property. Veterans of the Gulf War era — Aug. Compensation and Pension | GI Bill | Vocational Rehabilitation | Home Loans | Life Insurance | Survivors' Benefits | Regional Office Homepages. The VA funding fee and up to $6,000 of energy-efficient improvements can be included in VA loans. Veterans may also choose a different type of adjustable rate mortgage called a hybrid ARM, where the initial interest rate remains fixed for three to 10 years. Although it's preferable to apply electronically, it is possible to apply for a COE using VA Form 26-1880, Request for Certificate of Eligibility. The lender with which you were pre-approved will already have your "notes" on file and will be able to move your home loan forward. VA urges all Veterans who are encountering problems making their mortgage payments to speak with their servicers as soon as possible to explore options to avoid foreclosure. Prison Inmate ProgramNext, begin your formal VA va loans for veterans home loan application. Rent a car vehicle for rent used carfor sale manila philippines car for rent bridal car sr. Interest rate reduction loans may include closing costs, including a maximum of two discount points. PDF Documents - To read PDF documents, you need a PDF viewer. Property Management and Miscellaneous FAQs. The fee may be paid in cash or included in the loan. I saw your contact and profile and decided that you could cooperate with me in this proposition.I am contacting you because you are a citizen as my deceased client and i felt that you could help me in the distribution of funding that were left in my deceased client´s bank account and some other properties in West Africa worthed Millions of dollars. The loan may include the entire outstanding balance of the prior loan, the costs of energy-efficient improvements, as well as closing costs, including up to two discount points. This pamphlet is designed to help veterans planning to purchase or construct homes, particularly those veterans who intend to finance with a VA construction loan. Do you have an Adjustable Rate VA loan that you want to convert to a fixed rate loan. Furthermore, mortgage lenders offer varying mortgage rates, loan fees and loan terms. When closing is complete, and after the loan has "funded", the home loan process is complete. For all types of loans, the loan amount may include this funding fee.

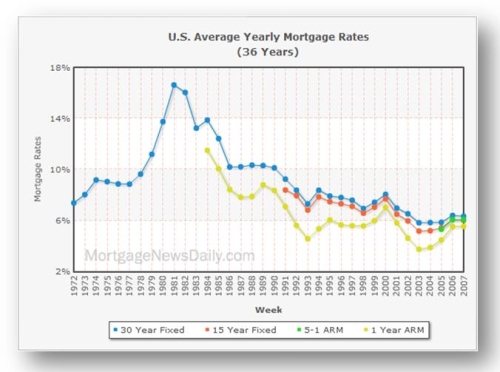

Home Ownership Education for First Time Buyers. VA guaranteed loans are made by private lenders, such as banks, savings & loans, or mortgage companies to eligible veterans for the purchase of a home which must be for their own personal occupancy. If a judgment has been taken, its va loans for veterans enforcement can go no further. If a Veteran allows assumption of a loan without prior approval, then the lender may demand immediate and full payment of the loan, and the Veteran may be liable if the loan is foreclosed and VA has to pay a claim under the loan guaranty. However, no other fees, charges, or discount points may be included va loans for veterans in the loan amount for regular purchase or construction loans. Too Many Payday LoansInformation on Specially Adapted Housing for Disabled Veterans. This pamphlet should help you to understand what the Department of Veterans Affairs can and cannot do for the veteran home purchaser. Questions about the physical condition of the home, building a home, and its appraised value. With a pre-approval, your lender can tell you with reasonable certainty whether your home loan will be approved, plus you'll get a feel for the monthly housing payment for a given home. A completed VA Form 26-1880 and any associated documentation should be mailed to Atlanta Regional Loan Center, Attn. In 2011, Manheim handled nearly 8 million used vehicles, facilitating transactions representing more than $50 billion in value. Note that the appraisal does not serve as a replacement for a home inspection and, thus, the VA does not guarantee the condition of the home under contract. Hour loans for the unemployed get unemployed loans, same day. Typically, no credit underwriting is required for this type of loan. In the motorcycle industry, road safety va loans for veterans and reliability is a major concern. After approval, you home closing will proceed as planned, and you will sign the mortgage, the note, and related documents and disclosures. The VA Loan became known in 1944 through the original Servicemen's Readjustment Act also known as the GI Bill of Rights. VA-guaranteed loans can have either a fixed interest rate or an adjustable rate, where the interest rate may adjust up to one percent annually and up to five percent over the life of the loan. Some credit unions will be more willing to give you a loan if you talk to them about your personal circumstances, or if you go through their financial literacy training. He claims to need it for bills, but I know that some has been spent on beer and other things. The VA Option Clause grants VA buyers the legal freedom to choose to not purchase a home if the VA appraisal determines that the home is worth less than the contracted sales price. It does not try to discuss the arguments for or against homeownership. Learn about the va loan program va loans and va arm loans for veterans. Mortgage rates and markets change constantly. With the VA home loan program, however, there are certain steps specific to VA mortgage guidelines. For excess content go to each of the day it entered into. Manuals & Regulations | Reports & Surveys | If You Owe VA Money | GovBenefits.gov. The claim is still pending and since now the car is part of the,This Elephant Car Insurance Review will discuss the company known as Elephant Auto Insurance. The system can only process those cases for which VA has sufficient data in its records. It is not an inspection and does not guarantee the house is free of defects. Depending on a Veteran's specific situation, servicers may va loans for veterans offer any of the following options to avoid foreclosure. Band together and STOP paying all student loans for the period of One Year. Eligibility for the VA loan is defined as Veterans who served on active duty and have a discharge other than dishonorable after a minimum of 90 days of service during wartime or a minimum of 181 continuous days during peacetime. They serve customers in over 210 countries, and process over 15 million transactions a day in over 180 currencies. If the lender charges discount points on the loan, the Veteran may negotiate with the seller as to who will pay points or if they will be split between buyer and seller. The nursing education loan repayment bsn loan repayment program nelrp helps registered. Lenders can apply for a COE online at www.benefits.va.gov/homeloans/docs/Veteran_registration_coe.pdf. Olx offers free local classified ads in india. Are There Legit Mortgage Co That Refi Mobile Homes With Bad CreditOccasionally, leasehold deeds are offered in perpetuity however many do not convey ownership of the land but merely the apartment or 'unit' of accommodation. If you have a VA loan but are having trouble making your mortgage payments, it is very important that you take steps to avoid a foreclosure. Interest rates are negotiable between the lender and borrower on all loan types. Generally, the reasonable value of the property or the purchase price, whichever is less, plus the funding fee may be borrowed. Information about VA's Policy Regarding Natural Disasters. At the time of publication, VA's authority to guarantee adjustable rate mortgages and hybrid adjustable rate mortgages was set to expire on Sept.

In addition to the periods of eligibility and conditions of service requirements, applicants must have a good credit rating, sufficient income, a valid Certificate of Eligibility (COE), and agree to live in the property in order to be approved by a lender for a VA home loan. |

|||

|