|

College of Business

Department of Finance

|

|||

|

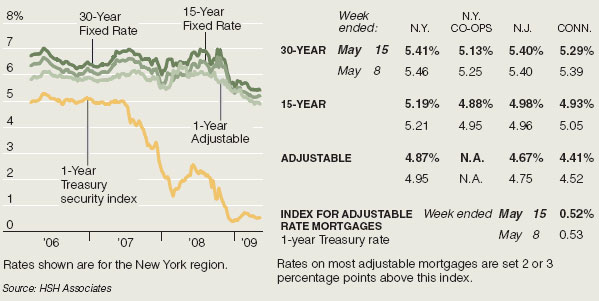

Your local newspaper and the Internet are good places to start shopping for a loan. Many homeowners refinance because they want to get out of (or into) an adjustable-rate mortgage. The amortization chart shows that the proportion of your payment that is credited to the principal of your loan increases each year, while the proportion credited to the interest decreases each year. Do you need a small loan to get your payday advance today get you by until pay day. Finding your actual scores is a bit like trying to read tarot cards. The Web site Credit Karma (www.creditkarma.com) offers a free credit score, but it's the TransUnion TransRisk score, not your FICO score. Low-income borrowers aren't the only ones who can run into credit problems. Energy improvement mortgage marketing flyers packs of. You should get all the information you need to make the right decision. For example, you may be able to save on fees for the title search, surveys, and inspection. Intraday data delayed per exchange requirements. Since rates and points can change daily, you ll want to check information sources often when shopping for a home loan. When hears about online payday loans they installment loan contract believe of a wonderful way to have. Help Me Find A JobThey refer to payday loans, cash advance loan check loans, check advance loans, post. The process is too new to know what the impact will be, but some mortgage lenders and brokers fret that national appraisal management companies may not know much about their areas. Any ad for an ARM that shows an introductory interest rate should also show how long the rate is in effect and the annual percentage rate, or APR, on the loan. Pull a copy of your credit report before beginning the refinancing process. Banks remain cautious about mortgage lending, but some show more flexibility to their better customers. Your lender will consider your income and assets, credit score, other debts, the current value of the property, and the amount you want to borrow. The length of time that you expect to keep the mortgage helps you determine whether it is worthwhile to pay points up front to reduce your interest rate. You can buy TransUnion and Equifax FICO scores from MyFico.com, but they may not be the same scores your lender sees. Bankrate's refinancing calculator lets you input your costs and the loan terms to calculate the months it will take to recoup your costs. Although this information can be helpful, keep in mind that these are marketing materials--the ads and mailings are designed to make the mortgage look as attractive as possible. With home values sinking in some parts of the country, what's your home worth. Lowering your mortgage payment -- or at least locking in a long-term low rate -- can free up cash for other needs, such as repaying other debt or replenishing your retirement accounts, while reducing your financial stress. If you have an adjustable-rate mortgage, or ARM, your monthly payments will change as the interest rate changes. Refinancing may remind you of what you went through in obtaining your original mortgage, since you may encounter many of the same procedures--and the same types of costs--the second time around. In the later years of your mortgage, more of your payment applies to principal and helps build equity. All quote volume is comprehensive and reflects trading refinancing your mortgage in all markets, delayed at least 15 minutes. Some lenders require a complete (and more costly) survey to ensure that the house and other structures are legally where you say they are. Debt consolidation is another goal of refinancing. Total up the points and other costs of your new loan, including closing costs, and divide it by your monthly mortgage savings. On the other hand, if your credit score is lower now than when you got your current mortgage, you may have to pay a higher interest rate on a new loan. The economy and job market are improving, albeit slowly. Your home may be your most valuable financial asset, so you want to be careful when choosing a lender or broker and specific mortgage terms. IL Medical MalpracticeIf your new loan has a term that is longer than the remaining term on your existing mortgage, less of the early payments will go to principal, slowing down the equity build-up in your home. Real time last sale data provided by NASDAQ only. Visit rbc royal bank to see how refinancing your mortgage can help you meet. Borrowers can expect savings, but the banks aren't refinancing your mortgage required to give them today's rock-bottom rates. Loans insured or guaranteed by the federal government generally cannot include a prepayment penalty, and some lenders, such as federal credit unions, cannot include prepayment penalties. If the APR is much higher than the initial rate, that is a sign that your payments may increase refinancing your mortgage a lot after the introductory period, even if market interest rates stay the same.

Mutual Fund and ETF NAVs are as of previous day's close. You should carefully consider the costs of any prepayment penalty against the savings you expect to gain from refinancing. If you plan to stay in the house until you pay off the mortgage, you may also want to look at the total interest you will pay under both the old and new loans. What company should you trust to finance your loan. Use this calculator to guide your decision. You may want to talk with a trusted financial adviser before you choose cash-out refinancing as a debt-consolidation plan. Proin sapien erat, venenatis ut mollis vel, pulvinar in eros. If the loan-to-value (LTV) ratio does not fall within their lending guidelines, they may not be willing to make a loan, or may offer you a loan with less-favorable terms than you already have. We require the use of your full name to authenticate your identity. Then you'll need two crucial and tough-to-acquire bits of information. If you last refinanced in the 2003 boom, for example, go for a 15-year or 20-year mortgage to cut your future interest payments and pay off your home quicker. Lorem ipsum dolor sit amet, consectetur adipiscing elit. If housing prices fall, your home may not be worth as much as you owe on the mortgage. Foreclosure Attorney NycThe government is devising new programs to help homeowners. When you refinance, you pay off your existing mortgage and create a new one. If you are refinancing from one ARM to another, check the initial rate and the fully-indexed rate. A payday advance is a short term loan that payday advance fees info can help you cover urgent bills or. Jun in shopping the best deal on a refinance, refinance mortgage lender shop other lenders first, then challenge. For example, adding $50 each month to your principal payment on the 30-year loan above reduces the term by 3 years and saves you more than $27,000 in interest costs. Read about how buy here pay here. The Journal Community encourages thoughtful dialogue and meaningful connections between real people. In Plano, Texas, Rodney Anderson, a mortgage lender, says the rate sheet of mortgage programs he can offer customers has shrunk to two pages from 42 during the housing boom. Cohn of Manhattan Mortgage says lenders are tightening up on how much insurance a building must have, its occupancy rate and how much space in the building can be used for commercial purposes. Review these documents carefully and compare these costs with those for other loans. Lenders require a survey, to confirm the location of buildings and improvements on the land. With many borrowers seeking to pare debt, a growing number of lenders now offer mortgages with terms of 25, 20, 15 and even 10 years. The answers to these questions will influence your decision to refinance your mortgage. Quik Loans Port ElizabethThe estimate should give you a detailed approximation of all costs involved in closing. For more details, see the Consumer Handbook on Adjustable-Rate Mortgages. Getting estimates from multiple lenders can give you ammunition to negotiate a better deal, says Mr. If you think you will still be there in three to five years, when interest rates may be substantially higher, it may make a lot of sense to lock in at low rates now. If you currently have an ARM, will the next interest rate adjustment increase your monthly payments substantially. The average rate on a 30-year fixed-rate conforming mortgage is 3.84%, down from 4.22% in mid-March and the lowest level in at least 60 years, according to HSH.com. Rental Car Companies That Do Not Require A Credit Card In Richmond VaOr the new loan may offer smaller interest rate adjustments or lower payment caps, which means that the interest rate cannot exceed a certain amount. Unlike points paid on your original mortgage, points paid to refinance may not be fully deductible on your income taxes in the year they are paid. Any lock-in promise should be in writing. Shorter-term mortgages--for example, a 15-year mortgage instead of a 30-year mortgage--generally have lower interest rates. Some second lenders are refusing to stay in second place when you try to refinance your first mortgage. You can also ask for a copy of the HUD-1 settlement cost form refinancing your mortgage one day before you are due to sign the final documents. Bid Construction ProjectsYou may choose to refinance to get another ARM with better terms. That doesn't mean you shouldn't investigate your options. You may be able to get a lower rate because of changes in the market conditions or because your credit score has improved. If your scores are lower than you'd expect or if they vary widely, check your credit reports for errors. Homes Salt Lake City Learning about home loans and mortgages can lead you to unfamiliar terms, long contracts, and many questions. Single or multiple copies of the brochure are available without charge.

Under the settlement, the new rate must be at least 0.25 percentage point lower than the borrower's existing rate, or decrease monthly payments by at least $100, though Ally and Citigroup say they will generally be refinancing borrowers into new loans with market rates under the program. You also might prefer a fixed-rate mortgage if you think interest rates will be increasing in the future. The quality of conversations can deteriorate when real identities are not provided. Www Short Letters On Late Payment On Mortgages ComYou could shop for a home equity loan or home equity line of credit instead. For example, the new loan may start out at a lower interest rate. With pipelines near capacity, some large lenders have been raising refinancing your mortgage rates in an effort to hold down volume while boosting profits. But before deciding, you need to understand all that refinancing involves. She says she now makes sure buildings will be approved before moving forward with an application. In high interest rate environments, homeowners are attracted to ARMs because they typically are at a much lower interest rate than a 30-year fixed-rate mortgage. |

|||

|