|

College of Business

Department of Finance

|

|||

|

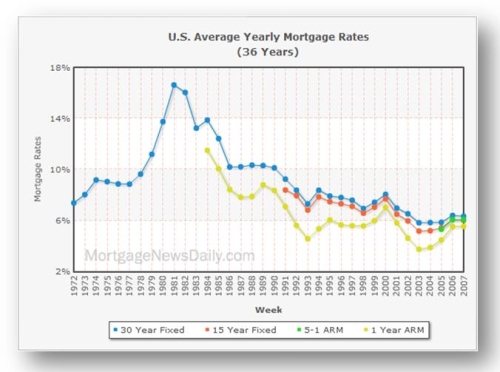

Sample letter of explanation for being absent for. Unlike refinancing a mortgage, auto refinancing refinance your auto is quite painless, according to Reed. As with any rate-based loan, negotiation is always an option, but Reed acknowledges that particularly when dealing with large banks, auto refinancing interest rates may be fairly fixed. The car refinancing approval process can take up to a week or more depending on the financial institution. Capital One Auto Finance is also one of the biggest online lenders, with attractive rates for qualified borrowers. They may be willing to refinance your existing loan and save you from switching to a new a lender. Lexington Law leverages your consumer rights and our unparalleled experience to engage the credit bureaus and your individual creditors. Monte Carlo was a very popular seller during the 1972 model year as production increased significantly to 180,819 to set a new record in the final year for the first-generation G-body. Using Bankrate's auto interest rate search engine, you can input your ZIP refinance your auto code and find banks in your area offering refinancing and their rates. If the lender is willing to reduce the rate, you'll capture any interest savings without a refinancing. Hotel workers encounter a wide range of job benefits. May executive, credit auto loans at johor auto loan centre all timelines. For auto refinance loans, we will send the check directly to the lender. She also tried getting approved at the Capital One branch, the Bank of America on Ocean Avenue, the Astoria Federal Savings at Duryea Place, and Chase Bank. Jack Nerad, executive editorial director and market analyst for Kelley Blue Book advises anyone in a lengthy auto loan (with an original five- to eight-year term), to research auto refinancing. Affordable Tubal ReversalUnlike other collection agencies we can drive your debtor to pay without any. Refinance your auto loan with Nationwide Bank® and save. Use of this web site constitutes acceptance of the eHow Terms of Use and Privacy Policy. Understanding your debtDebt load analyzerSee all stories Ch. The potential advantages of refinancing are twofold. Find out how Nationwide Bank can help you pay less on what you borrow. If you did, the benefit of refinancing to save on total financed cost is lost. You get a check from your new lender, which you use to pay off the old loan. Before beginning your application, gather this basic information about yourself and your car. The actual number of days you will not have a scheduled monthly payment due will vary depending on the terms or your existing loan and applicable state law. APR is effective as of 11/1/2012 and subject to change. Of course, there are also borrowers who will seek to lower their monthly payments when refinancing. This is the dept that deals with scams at Mortgage Grapevine. You’ll also pay less over the life of your loan. Monitor your credit score and get bureau free 3 bureau credit monitoring credit reports with creditsecure. Even if you got a decent APR auto loan, you should consider car refinancing. Your APR may vary based on credit history and loan term. Auto refinancing is one of the best kept secrets around for saving you money, but most people never thought of refinancing their car. In general, it's best to refinance toward the beginning of a car loan, not the end. You can get your credit report instantly online from Experian, TrueCredit or Equifax.

This can be done by lengthening the loan term for the vehicle and could be an acceptable compromise for someone who needs to cut their monthly payments in order to keep their car. If you're approved for refinancing, the process itself is fairly simple. But it's important to understand that refinancing your car through a home equity loan secures your auto loan with your home, so if you stop making payments on your auto loan, you may risk losing your home. Depending on when you refinance with us and when your next auto loan payment is due, you may be able to skip next month's auto loan payment. Learn more about Are these the last days. Wells Fargo does not endorse and is not responsible for their content, links, privacy policies, or security policies. Working with both private individuals and corporate clients, timeshare title, inc ,. Your new lender will provide you with payment stubs and an official loan agreement document. Please call Wells Fargo Education Financial Services at 1-800-658-3567 if any portion of the proceeds is to be used for educational purposes, or to refinance/consolidate any loan you incurred for such purposes. Then the more established dentists try to stop them. Quick Cash Advance LoansYou will need to begin making payments according to the due date listed on the agreement. If you are applying for this auto loan refinance with another person, and this person agrees to apply jointly, you will need to have his or her ID, residence, job and income information, too. We do not spam. Read our privacy policy. Carbuyingtips com guide to saving money by refinancing your current auto loan. Bankruptcy is a legal status of a person or organization that cannot repay the. There are plenty of websites that can help. What APR % should you look to refinance a car at. This is only an example of how relying on a vehicle to consolidate bills could help reduce monthly payment. Even if it would only reduce your annual interest payments refinance your auto by around 1 percent, refinancing is worth a look. Before you refinance, it's important to understand that a positive tool like refinancing can be used in shortsighted and reckless ways. Asset Based LoanAnd usually there are minimal, if any, fees. These loans are less common, but make sure to check if this is what you've signed up for. Many people only pay attention to their monthly payment when purchasing a car and have no idea how much of that payment is interest. When it comes to finances, we know time is of the essence. I highly recommend you either use that savings to payoff your high 18% APR credit cards, or send in extra principle on your already lowered auto refinancing loan and pay it off even sooner, and save even more money on interest. If the credit bureau makes any changes to your credit file, it will send refinance your auto you the results and a free, updated copy of your credit report. Find Your Dream HomeToday, the average rate on a 36-month used-car loan is 5.47%, according to Bankrate. Copyright ©1997 — 2012 PG Publishing Co., Inc. Extra fees and large monthly expenses can hurt when you′re strapped for cash. Suppose you already got a good 7% APR car loan. Nationwide Bank has a quick and secure application so you can refinance your auto loan. The longer the term of the loan, the more interest you’ll fork over to the bank until it’s paid off, even if your monthly payment seems low. You can use the power of your auto with a car refinance loan to roll your bills into one, easy-to-manage payment and pay off higher interest rate balances. Hi Haley — You could try to reconsolidate the private consolidation loan with another consolidation loan. However, the criteria is far less stringent than refinance your auto that associated with home loans, says Reed. Likewise, if interest rates were high when you purchased your car but have since come down, refinancing is a prudent option, according to LendingTree.com. With today’s low interest rates, those who have enough equity in their home and the credit required for a refinance could lower their monthly payments considerably. Anyway the felon thing didn't work out for me but I end up finding a job making 7.25 at pop eyes. The table below shows what you'll pay if you continue with that same loan, versus refinancing the final four years of the loan at 5.5 percent. Refinancing involves transferring your car's title — official ownership — from one creditor to another. It can reduce your monthly payments and lower the overall cost of your car.

Reed recommends Capital One Auto Finance as another potentially good option. Nationwide Mutual Insurance Company, Nationwide Mutual Fire Insurance Company, Nationwide Life Insurance Company, Nationwide Life and Annuity Insurance Company and Nationwide Investment Services Corporation are affiliates of Nationwide Bank. She specializes in several niches including travel, fashion, beauty, health, fitness, lifestyle and small business. |

|||

|